Last quarter I watched a rep spend 27 minutes writing a “quick follow-up” that said… almost nothing new. Meanwhile, the buyer had already visited our pricing page twice and was comparing us with two competitors. That little moment sent me down a rabbit hole: not “Should we use AI?” but “Where does AI actually move the needle in sales operations?” This post is my field notes—equal parts excitement and skepticism—on AI sales tools, predictive analytics, and the weirdly human work that’s left once the busywork is gone.

1) The day I realized my team needed digital coworkers

I still remember the week I hit “follow-up purgatory.” Deals weren’t dying because prospects said no—they were dying because we were slow. A rep would have a good call, promise a recap, then get pulled into admin, CRM updates, and “quick” internal asks. Two days later, the buyer had moved on. Buyer expectations were rising, competitors were faster, and our sales team composition didn’t match the workload.

So I ran my first test with task automation followups. Not a shiny chatbot. Just an AI workflow that drafted recap emails, suggested next steps, and created CRM tasks through CRM integrations agents. That’s when I started thinking of AI as a digital workers transition, not an add-on to our stack.

Why I say AI agents essential (and what they actually do)

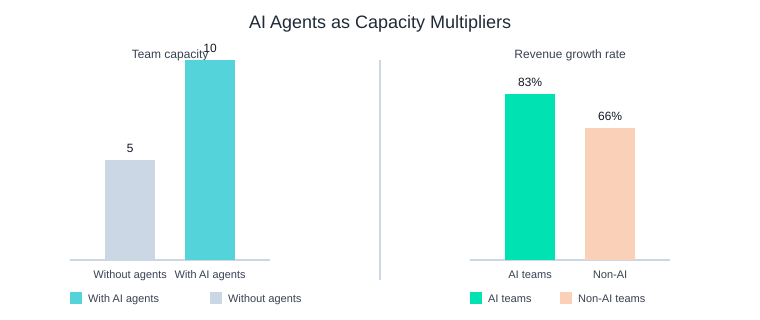

To me, AI agents essential means this: they don’t replace reps—they take the annoying 30% of the job that steals momentum. Research in AI sales operations shows AI can lift sales productivity by up to 30%, and teams using AI report revenue growth more often (83% vs 66% without). That’s the sales efficiency boost I needed: more selling time, fewer dropped balls, and better timing.

Kendra Schaefer: “The most valuable automation isn’t the flashy kind—it’s the boring work you stop noticing until it disappears.”

Before/after: where prospecting precision breaks (and how AI sales tools patch it)

- Before: Follow-ups depended on memory → After: AI schedules and drafts follow-ups automatically

- Before: Notes lived in call recordings → After: AI summarizes and logs next steps (revenue operations automated)

- Before: Leads were “hot” in theory → After: AI flags intent signals and learns from outcomes (autonomous decisions learning)

The tangent that mattered: my best rep was process-light

Our top performer hated process—and still won. The rest of the team tried to copy her, but without her instincts, things slipped. AI flipped that script: it carried the process for everyone, so even process-light reps stayed consistent. Suddenly, a 5-person team could operate closer to a 10-person capacity because agents handled the background workload.

What I tracked

- Rep time spent on follow-ups

- Meeting-to-next-step rate

- Hours lost to admin

| Metric | Result / Benchmark |

|---|---|

| Workload capacity | 5-person team managing 10-person capacity (with AI agents) |

| Sales productivity lift | Up to 30% with AI |

| Revenue growth comparison | 83% AI teams vs 66% non-AI teams |

2) Predictive analytics forecast: my messy relationship with numbers

I used to run pipeline reviews on gut feel. I’d scan deal notes, ask a few loud questions, and “sense” the quarter. It felt fast, but it wasn’t honest. When a predictive analytics forecast first entered our process, I was skeptical—and I also broke it. I fed it messy CRM fields and let it over-weight an old segment that used to win easily. The model looked confident, and we missed the real shift in buyer behavior.

Thomas H. Davenport: “Analytics doesn’t eliminate judgment; it teaches judgment where it’s been lazy.”

Why I stopped trusting gut-feel—and what changed

Once we cleaned the basics (stages, close dates, next steps), our AI forecast accuracy stopped being “magic” and started being measurable. The unglamorous win was data hygiene: fewer blank fields, consistent definitions, and no “hope” stages. That’s when forecast revenue accuracy began moving in the right direction, and our revenue intelligence performance improved because reps could see why deals were slipping.

The inputs that actually matter

- Buyer engagement data: email replies, meeting attendance, multi-threading, and late-stage silence

- Historical win rates: by segment, product, and deal size (not just rep averages)

- Seasonal patterns: budget cycles, procurement slowdowns, and renewal timing

A mini competitive situations analysis: the risk we missed

In one “sure thing” deal, the model flagged risk because engagement dropped after the security review. Our team thought it was normal legal delay. The predictive analytics view showed a pattern: when a competitor enters late, stakeholders go quiet and meeting cadence breaks. We adjusted fast—added an exec sponsor, tightened mutual action plans, and requalified. We didn’t win, but we stopped forecasting it as committed, which protected the quarter.

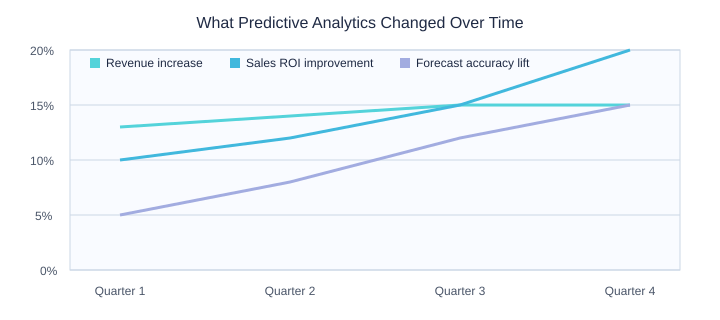

Economic indicators: the forecast lives in the real world

I also learned the forecast is only as honest as the world it lives in. When rates rose and budgets froze, we updated assumptions and stopped comparing to “normal” years. Early AI adopters get a compounding advantage because models keep learning from real customer data, and companies using AI often see 13–15% revenue increases and 10–20% better sales ROI.

My cadence is simple: weekly calibration (what changed, what signals moved) and a monthly post-mortem:

- Where was the model right or wrong?

- Which fields were missing?

- What process change prevents repeat errors?

| Metric | Range |

|---|---|

| Forecast revenue accuracy improvement target | +10% to +20% |

| Revenue lift associated with AI usage | +13% to +15% |

| Sales ROI improvement range | +10% to +20% |

4) Conversation intelligence insights: the ‘silent’ coaching win

The most surprising place AI helped me wasn’t forecasting—it was conversation intelligence insights. In live calls, I thought I heard everything. But AI-based conversation intelligence surfaced patterns I simply couldn’t catch in the moment: where buyers got stuck, which competitors came up, and which questions actually moved the deal forward. That “silent” layer became my best coaching input because it was based on buyer engagement data, not memory.

Personal aside: I used to think note-taking was my superpower; turns out it was my bottleneck. When I was typing, I missed tone shifts, objections, and the real decision criteria. Once calls became searchable and tagged, I could focus on the buyer—and still get clean, consistent insights afterward.

Gong.io co-founder Amit Bendov: “The call isn’t just a conversation—it’s data. Once you treat it that way, coaching stops being opinion.”

From calls → deal risk → next best action (without micromanaging)

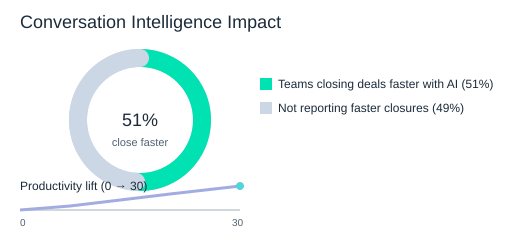

What clicked for me is how revenue intelligence insights connect the dots: call moments map to deal risk signals (pricing pushback, missing stakeholders, weak next steps), and then suggest a “next best action.” Done right, this supports revenue intelligence performance without turning managers into hall monitors. It’s guidance, not micromanagement—and it removes bottlenecks. That matters because research shows 51% of revenue teams close deals faster with AI by removing friction and providing insights, and AI can drive a sales efficiency boost with productivity lifts of up to 30%.

Instant replay for selling

I treat call insights like instant replay in sports—useful, but only if you run the next play. The replay helps me spot competitive situations (who we’re up against, what claims land) and buyer engagement signals (who spoke most, where interest spiked). Then we act: tighten discovery, confirm stakeholders, and set a clear next step to get deal closures faster.

Guardrails + a lightweight coaching loop

- Privacy and consent: tell buyers calls are recorded, and honor opt-outs.

- Culture: avoid “gotcha” surveillance; frame this as skill-building.

- Cadence: one insight per rep per week, and celebrate small improvements.

| Metric | Data |

|---|---|

| Deal velocity finding | 51% of revenue teams close deals faster with AI |

| Sales productivity lift | Up to 30% |

| Coaching cadence | 1 insight per rep per week |

5) Sales technologies ROI: the part everyone skips (until the CFO asks)

I used to buy tools because the demo looked smart. Now I start with a blunt question: “Which workflow gets cheaper, faster, or less error-prone?” If I can’t name the workflow, I can’t defend the sales technologies ROI when finance asks.

Mary Meeker: “ROI is the language that turns ‘interesting’ into ‘funded.’”

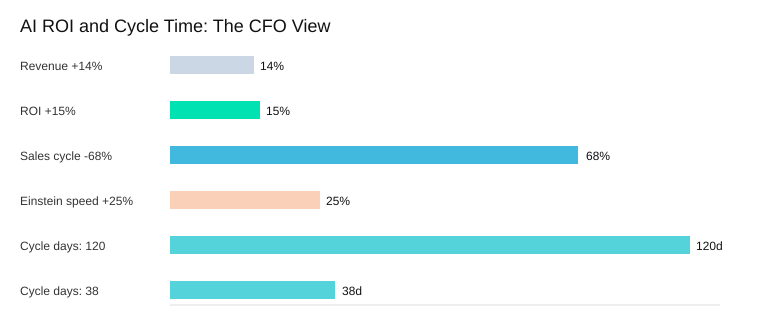

Real results roundup: revenue lift, ROI gains, and sales cycle reduction

In the field data I track from Revolutionizing Sales Operations with AI: Real Results, the pattern is consistent: companies using AI report 13–15% revenue increases, 10–20% better sales ROI, and up to 68% shorter sales cycles. Those aren’t “nice-to-have” gains—under competitive pressure, sales cycle reduction is how you keep pipeline from stalling and get deal closures faster.

- Sales automation benefits show up first in admin time: logging, follow-ups, routing, and next-step reminders.

- Fewer handoff errors means fewer “lost in the cracks” deals and cleaner forecasting.

- Shorter cycles compound: faster quotes, faster approvals, faster renewals.

Why CRM integrations agents decide adoption

My biggest lesson: CRM integrations agents are the make-or-break. Adoption lives inside the systems reps already use. If AI requires a new tab, a new login, or extra fields, it dies. If it writes notes, updates stages, and suggests next actions inside the CRM, it sticks—and that’s when AI investments increase because the CFO can see the trail.

Concrete example: Salesforce Einstein and faster deal closures

Salesforce reports Einstein users close deals 25% faster. Operationally, that matters because it reduces rep waiting time between steps (research, outreach, follow-up) and helps managers coach with real activity signals, not gut feel.

Another case: one manufacturer cut the sales cycle from 120 days to 38 days. That’s not just speed—it’s cash flow, capacity planning, and fewer discounts to “save” late-stage deals.

My imperfect framework: one metric, one team, one month

- Pick one metric (cycle time, meetings set, or time-to-quote).

- Pick one team (SDR pod or one region).

- Run one month, then expand or kill it.

CFO-friendly scorecard

- Cost saved: hours reduced, tools consolidated

- Pipeline impact: conversion, velocity, win rate

- Risk reduction: compliance, data quality, forecast variance

| Metric | Reported result |

|---|---|

| Revenue increase with AI | 13% to 15% |

| Sales ROI improvement with AI | 10% to 20% |

| Sales cycle shortening | Up to 68% |

| Salesforce Einstein | Deals closed 25% faster |

| Manufacturer case | Sales cycle 120 days → 38 days |

6) Future AI agents: the 2026 sales trends 2026 I’m watching

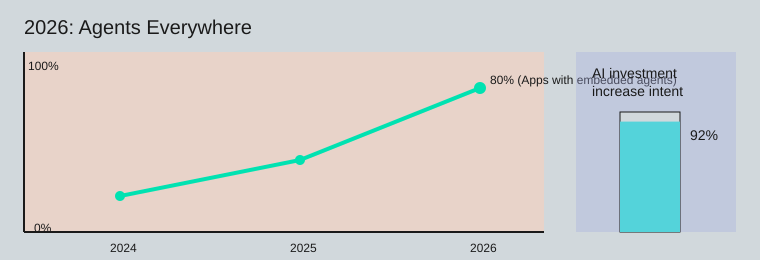

When I look at sales trends 2026, I don’t just see “better tools.” I see future AI agents becoming autonomous coworkers inside the systems we already use. One research signal I can’t ignore: 80% of enterprise apps will embed agents by 2026. Pair that with the broader context that 92% of companies plan to increase AI investments in the next three years, and it’s clear why early adopters keep gaining speed—buyer expectations rise, and the gap compounds.

Satya Nadella: “Every business will become an AI-first business—because every workflow will be redesigned around intelligence.”

AI trends sales in 2026: what becomes “default”

Based on what I’m seeing in “Revolutionizing Sales Operations with AI: Real Results,” the AI trends sales that move from “nice to have” to “standard” are: scaled personalization, intelligent automation, and dynamic lead scoring. Scaled personalization means generative AI content that adapts by persona, industry, and deal stage—without sounding like a template. Intelligent automation means the busywork disappears (logging, follow-ups, routing). Dynamic lead scoring means intent, engagement, and fit update in near real time, so reps stop chasing yesterday’s priorities.

What multi-agent systems look like in a normal week

I expect multi-agent systems and AI agent teams to show up as a set of small specialists that coordinate. In a typical week, I can imagine a pipeline hygiene agent cleaning stages and next steps, a meeting prep agent building a tight brief from CRM + emails, and a renewal risk agent flagging accounts where usage or sentiment is dropping. The best part is how these agents feed outreach and account plans: they don’t just write messages—they suggest who to contact, when, and why.

The governance bit (sorry, but necessary)

Autonomy forces ownership questions: who owns prompts, permissions, and “autonomous decisions learning”? In 2026, governance will be a sales ops skill: define what agents can change, what they can recommend, and what must stay human-approved.

My tiny prediction: we’ll hire for “sales team composition” on purpose—humans plus agents. My 90-day roadmap teaser is simple: audit, pilot, integrate, measure. And even as agents get smarter, I still don’t want to automate relationship judgment, ethics, or tough negotiations.

| Signal | Value | Timeline |

|---|---|---|

| Enterprise apps embedding agents | 80% | 2026 |

| AI investment increase intent | 92% | Next 3 years |

TL;DR: AI sales tools are starting to act like extra teammates: they automate follow-ups, sharpen smart lead scoring, and improve forecast revenue accuracy when fed clean CRM data. Real-world benchmarks show up to 30% productivity lift, 13–15% revenue gains, 10–20% better sales technologies ROI, and up to 68% shorter sales cycles. The 2026 wave is less “one magic model” and more multi-agent systems embedded in everyday apps—so the winners will be teams that redesign their workflows, not just buy software.